There are all kinds of ways to make money in the metaverse – design NFTs, perform music, host an event, flip virtual land, and so on. However, each of these methods take time, skill, and hard work – and not all of them are passive. But one is, and it doesn’t take much time or skill: staking.

What is Staking in the Metaverse?

Metaverse staking is kind of like investing money in a savings account. We typically open a savings account to earn interest.

Similarly, you stake metaverse cryptocurrencies so that they earn interest. Digital currencies gain value when investors hold rather than sell. So, if investors stake, they are basically promising not to spend their holdings so that the value can go up.

The amount staked is typically locked so that the investors can’t withdraw, sell, or use their holdings during the staking period. This guarantees that the collective amount staked won’t be spent, thus increasing confident in the currency’s value.

How do I Stake in the Metaverse?

Each metaverse platform offers its own staking setup (if they even offer staking at all). You’ll typically find it on their website or dAPP (decentralized app). As of this writing, Meta Ruffy and The Sandbox offer ongoing staking for all users.

Each platform’s staking works slightly differently, but they all require users to have a crypto wallet. This might be MetaMask, TrustWallet, or something similar. Basically, a wallet is an application that holds your crypto balance, similar to how an actual wallet holds your cash.

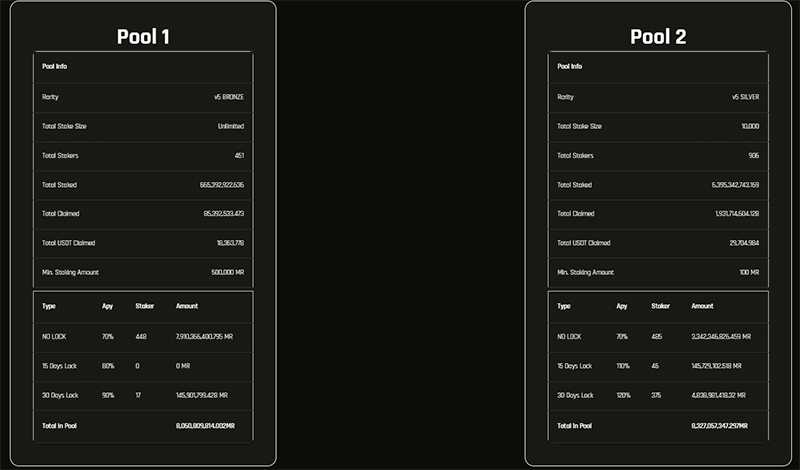

Once your wallet is connected, it’s as simple as following your chosen platform’s directions. First, you’ll need to choose a pool. Here’s a little more on that.

Staking Pools

You’ll typically have options when staking a cryptocurrency. You might want to stake some of your holdings and keep some ready for use. Or, you might want to stake everything. You may even have a limited budget to work with.

Staking pools offer flexibility for different preferences. Some pools have a low minimum investment amount for holders with smaller budgets. These pools have smaller rewards but are more accessible.

Obviously, staking pools with larger minimum deposits offer a higher yield. This means a higher percentage for your overall rate of return.

But staking pool options don’t stop there. You can also choose how long you want to stake your holdings for. As expected, pools with a higher duration yield a higher percentage of return. However, that also means more time during which your crypto will be unavailable for use of any kind.

Staking Options

Some platforms will allow you to stake more than just cryptocurrencies. You may also stake the value of your land and NFT holdings. Again, both Meta Ruffy and The Sandbox allow this (among others). However, the incentives will vary among different platforms.

Benefits of Staking in the Metaverse

- High-yield interest

- Preserved crypto value

- More project opportunities

The Cost of Staking in the Metaverse

Cryptocurrencies, virtual land, and NFTs are all tied to the blockchain. So, there are usually gas fees associated with transactions related to staking. You typically have to pay a staking gas fee when:

- You deposit assets to stake

- You claim your earnings

- You claim your original staking deposit

- You move from one staking pool to another

This is why it’s important to consider your reason for making any changes to your staking pool. Will your gains offset the gas fees? Typically yes, but not always.

Staking Risks

Metaverse staking doesn’t come without risk, although those risks are generally low. Here are a few of the most common:

- Potential for lost value: Staking earns interest on whatever cryptocurrency you have invested, not on the overall value of your investment. So if the currency’s value drops substantially, you may still lose value from your initial investment even if you’re earning more of that particular currency.

- Promotional yields: Meta Ruffy recently raised its APY to %1000 in celebration of its land sales going live. The massive yield was only available for investors who staked at least 30 days. However, the promotional yield only lasted 1 week. This means that investors who didn’t claim the awards they earned at the higher APY at the end of that 1 week period saw their investment revert back to the standard APY. Remember this when promotional yields are offered on any platform.

- Funds are nnavailable: Unlike savings accounts, staking platforms can prevent you from accessing your funds (or the value of your NFTs) during the staking period. This has become an industry norm, so you’re unlikely to find someone who will make an exception for you. In fact, in many cases, not even the platform’s developers can release your funds ahead of time.

Recent Comments